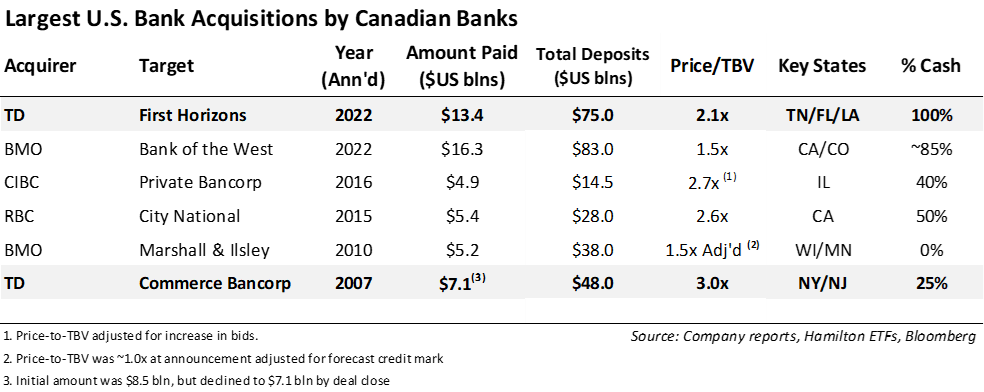

After much speculation in recent years about its appetite for additional U.S. bank M&A, TD offered ~US$13.4 bln in cash to buy First Horizon Corporation (FHN)[1], a Tennessee-based regional bank, in late February, almost 15 years since its last “large” U.S. bank acquisition – Commerce Bancorp. In our view, the acquisition offers many strategic benefits given FHN: (i) is an optimal size, adding material scale with manageable integration risk, (ii) has a highly complementary geography (23% of FHN’s deposits are in MSAs in which TD has a presence[2]), and (iii) operates in some of the most attractive markets/MSAs in the country (high GDP and/or population growth). Post-acquisition, TD will be a top 10 commercial bank in the U.S., by deposits[3].

In terms of deal structure, the TD/FHN deal is a near carbon copy of BMO’s December 2021 acquisition of Bank of the West (BoW) – the largest acquisition ever announced in Canadian bank history at US$16.3 bln. As we wrote in January, that deal was unprecedented in nearly every aspect (see, “BMO’s High Risk, High(er) Reward Acquisition of BoW”; January 27, 2022). Then almost exactly two months later, TD announced the acquisition of First Horizon for US$13.4 bln – the second largest acquisition ever announced by a Canadian bank (see table below). These acquisitions are so large – $30 bln in combined proceeds – the results of these newly acquired platforms will almost certainly influence marginal returns in the coming years.

Before we speak about the transaction, we would like to highlight the recent launch of the Hamilton Enhanced Canadian Financials ETF (HFIN), which is structured similarly to our popular Hamilton Enhanced Canadian Bank ETF (HCAL), the top performing Canadian bank ETF in Canada. Since it was launched in October 2020, HCAL has outperformed equal weight and covered call Canadian bank ETFs by a highly material 11.3% and 26.2%[4], respectively. HFIN offers added diversification by investing in the top 12 largest Canadian financials by market capitalization and has an indicated yield of 5.94%, similar to HCAL at 6.14%[5]. Both HCAL and HFIN, which pay monthly distributions and utilize modest leverage of 25% to enhance the growth and yield potential for investors.

Note to Reader: Unless otherwise stated, figures are in U.S. dollars and the source of market share and deposit information is S&P Global Market Intelligence. For TD Bank, total deposits exclude “sweep” balances related to Schwab, assumed to be $146.9 bln[6]. Also, for simplicity, Metropolitan Statistical Areas (MSAs)[7] will be referred to by their anchor city. For example, the Miami-Fort Lauderdale-Pompano Beach, FL MSA is referred to as Miami MSA. We include Louisiana in the Southeast region, but note some maps place it in the Southwest.

Now, to TD/FHN and the main takeaways of the transaction.

First, on a high level, the TD/FHN transaction, like that of BMO/BoW, relies heavily on financial engineering.

Both transactions were cash heavy (TD 100%; BMO ~80%), facilitating high forecast EPS accretions of ~10% as each bank only needs to out-earn “cash”. In addition, both transactions included a huge credit mark and a restructuring charge of ~$2 bln+. This is important since, if history is an indicator, these estimates are likely to be conservative, significantly increasing the probability that each bank not only meets its material forecast EPS accretions but exceeds them.

TD forecast a credit mark of ~$900 mln (or 1.6% of gross loans) and a restructuring charge of $1.3 bln for ~$2.2 bln. Similarly, BMO forecast a $2.1 bln combined credit mark and restructuring charge[8]. Given the size of these two transactions, any potential conservatism embedded in these “cushions” provides meaningful insurance/margin for error on execution. This is important to investors given the significant forecast cost synergies (over 30% of target for each), which – all things being equal – increase integration risk.

Second, FHN is an excellent strategic fit, by both size and geography.

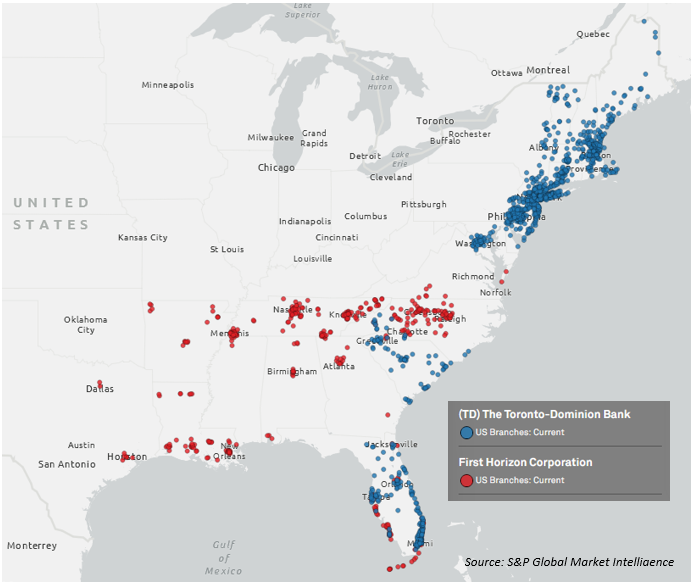

First Horizon increases the size of TD USA’s commercial banking platform by nearly 35%[9], adding meaningful scale. It also offers a highly attractive and complementary geography to TD USA. Currently, TD USA is dominated by the wealthy, albeit slower growth Mid-Atlantic and New England regions, including large branch networks in the NYC, Philly and Boston MSAs. With the acquisition of FHN, the bank gains over 400 branches and ~$75 bln in deposits virtually all in the high growth Southeast region, primarily in Tennessee, Florida, Louisiana, and North Carolina[10]. The map below shows the geographic bridge FHN forms between TD USA’s northern U.S. platform and its branch clusters in South Carolina and Florida, and the new reach it provides moving west along the Gulf Coast toward east Texas, with a large platform in Louisiana, and smaller platforms in Arkansas and Mississippi. No fit is perfect, but First Horizon adds scale and geographic cohesion to TD’s currently somewhat bifurcated platform.

Third, TD significantly strengthens its market position in highly attractive Florida.

The FHN acquisition will nearly double TD’s footprint in Florida, one of the most attractive states in the U.S. from both economic growth and demographic perspectives. TD’s deposits will rise from ~$20 bln to $35 bln and its deposit market share in the state will increase to a strategically important top #5. Crucially, the deal will significantly advance TD’s market position in key markets, especially Miami – the 8th largest MSA in the country. Post-transaction, TD will have over 100 branches and ~$20 bln in deposits in Miami for a #6 market position. The bank also increases its positioning in Orlando (doubling deposits to #5) and Tampa (increasing deposits by ~25% to #8), as well as several highly desirable MSAs along the Gulf Coast, including Naples (#5), Cape Coral-Fort Myers (#7), Key West (#1) and Sarasota (#8).

Fourth, TD will become #1 in Tennessee, a burgeoning banking market.

Canadians are well aware that Florida is a fast-growing state with great demographics. Less commonly known is that Tennessee is among the most attractive banking markets in the country and has a GDP/capita notably higher than virtually every Canadian province, including Ontario[11]. This is especially true for eastern Tennessee, including Nashville, which accounts for nearly 9% of FHN deposits (#5 market position). Nashville is projected to have the fourth highest population growth among the 40 MSAs with population greater than 1.5 mln and double the U.S. average[12]. FHN also has strong positions in Knoxville (#2) and Chattanooga (#1), which account for another ~10% of the platform and have projected population growth 50% higher than the U.S. average. Memphis (where FHN has #1 share), however, has forecast population growth lower than the U.S. average.

The Hamilton U.S. Mid/Small-Cap Financials (HUM) has material exposure to the Southeast and Florida and Tennessee, in particular. Since 2000, the U.S. mid-cap financial index has materially outperformed the large-cap financial index, rising ~9% (annualized) versus the large-caps at 5%[13]. This large and diverse category of financials allows investors to gain more direct exposure to areas of the U.S. where GDP growth is 50% to 100% higher than the national average (namely, the Southeast, Southwest, and parts of the West regions). More specifically within the mid-cap financials, the mid-cap banks have been – and continue to be – the epicenter of M&A. HUM has exposure to many U.S. mid-cap banks that by virtue of their size, higher growth geographies, and franchise quality are expected to participate in the ongoing consolidation of the U.S. banking sector. Last year, HUM was the top performing financials ETF in Canada, and was among the top 10 performing ETFs in all of Canada according to Morningstar.

Fifth, FHN is already a successful bank; it’s not a “fixer upper”.

In the case of BMO/BoW, it was notable that the BoW platform generated ROE/ROAs well below industry averages over the last several years. These weaker operating metrics are – at least in part – related to the sprawling platform of BoW[14]. Therefore, BMO – a significantly better managed bank – has the opportunity to create incremental shareholder value by improving the underlying operating performance. This is not the case for TD/First Horizon. By virtue of it being a public company subject to the higher expectations of the equity markets, FHN has much stronger operating metrics, including an ROE over 12% and ROA over 120 bps – both in line with industry averages. All things being equal, this should, in our view, reduce integration risk.

Sixth, integration risk is met with a unique retention strategy.

Investors are concerned about integration risk from the TD/FHN transaction. Not only is this deal transformative to TD’s U.S. platform, but it also comes shortly after FHN itself completed a transformational merger of equals with IBERIABANK (IBKC). To mitigate this risk, TD is “investing” ~$500 mln in retention, including allocating $150 mln to front-line branch associates, bankers, and technology and operations staff. One of the preeminent authorities in U.S. banking, Rodgin Cohen of Sullivan and Cromwell, recently noted in a Bloomberg sponsored webinar this could set a new industry standard for retention packages[15].

Seventh, TD likely to focus on Georgia/Florida, over Texas.

The investor presentation highlights that the FHN acquisition opens the bank to further expansion in Texas (Houston/Dallas) and Georgia (Atlanta). As noted above, this geographic bridge to Texas takes the form of FHN branches spanning from the Southeast to the Southwest via Georgia, Alabama, Mississippi, and Louisiana (where FHN is the 4th largest bank). Texas is arguably the most competitive and strategically attractive state in the U.S. and FHN currently has 9 branches and nearly $2 bln in deposits mostly in Houston[16]. That said, we believe if TD were to adopt a large de novo strategy, it is more likely to focus first on Georgia over Texas, given its strong platform in all surrounding states (SC, NC, TN, AL and FL) and FHN’s small foothold in Atlanta (9 branches, $1.7 bln in deposits). We also expect TD to focus on building on its newfound scale in Florida.

What does this mean to TD?

Overall, of the universe of U.S. regional and mid-cap banks, we believe the acquisition of First Horizon was among the best possible alternatives to strategically advance TD’s platform. FHN offers meaningful scale and excellent geography, including building out in two higher growth states: Tennessee and Florida. It also adds geographic cohesion to TD’s somewhat bifurcated platform. The cash-heavy deal structure supports material 10% forecast accretions, which, coupled with a huge $2.2 bln in restructuring charges/credit markets, increases the probability TD will meet if not exceed these forecasts. All in all, we believe TD has acquired a highly complementary target to augment its existing platform.

TD Bank is a 10.5% weighting[17] in the Hamilton Enhanced Canadian Financials ETF (HFIN), which holds over 90% Canadian banks and insurers. Our Hamilton Enhanced Canadian Bank ETF (HCAL) and Hamilton Canadian Bank Mean Reversion Index ETF (HCA), which were the top performing Canadian bank ETFs in 2021, also have indirect and direct exposure to TD. Since inception in October 2020, HCAL is the top performing Canadian bank ETF, materially outperforming equal-weight and covered call strategies by 11.3% and 26.2%, respectively, and has a 6.14% yield[18].

Recent Insights

Canadian Banks: 2022 starts with M&A; Recovery Continues (fQ1 in Charts) | March 11, 2022

Canadian Banks: BMO’s High Risk, High(er) Reward Acquisition of BoW | January 27, 2022

HCA/HCAL Lead All Canadian Bank ETFs in 2021 | January 26, 2022)

Canadian Banks: Five Possible Drivers in 2022 (Q4 2021 in Charts) | December 17, 2021

U.S. Banks: M&A Features Prominently on Q1 Calls | April 30, 2021

U.S. Banks: The Return of M&A – A Clear Sign of Bankers’ Conviction in the Recovery | December 16, 2020

One Chart: U.S. Bank M&A Doubles in 2019 (and Why We Expect More) | January 24, 2020

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at the bid/ask spread). It is recommended that investors use limit orders.

[1] The Hamilton U.S. Small/Mid-Cap Financials ETF (HUM) owned First Horizon at the time of the deal announcement and exited the position post-announcement.

[2] This is significantly higher than BMO/Bank of the West, with just ~4% of BoW deposits in overlapping MSAs.

[3] Source: Investor presentation.

[4] From October 14, 2020 through April 29, 2022.

[5] As of April 29, 2022.

[6] Source: Call reports for TD Bank NA and TD Bank USA.

[7] Per Census.gov, MSAs “consist of the county or counties (or equivalent entities) associated with at least one urbanized area of at least 50,000 population, plus adjacent counties having a high degree of social and economic integration with the core as measured through commuting ties.”

[8] Credit mark of ~$770 mln, 1.3% of loans, and a restructuring charge of $1.3 bln

[9] Excluding SCHW sweep deposits.

[10] FHN also has branch networks in Southeastern states Alabama, Georgia, South Carolina, and Virginia. Outside of the Southeast, it has a small platform in Texas, which is in the Southwest (9 branches, ~$2.2 bln in deposits, virtually all in Houston) and a very small percentage of deposits in the NYC MSA.

[11] Source: National Bank Financial, Hamilton ETFs

[12] Source: S&P Global Market Intelligence, Hamilton ETFs. Pre-pandemic, we visited Nashville; see “Notes from Nashville: Titans of Growth”.

[13] S&P 400 Mid-Cap Financials Index versus the S&P 500 Financials Index.

[14] Bank of the West operates in over 100 MSAs, including 50 MSAs where the bank has a single branch.

[15] Rodgin Cohen of Sullivan and Cromwell represented First Horizon in its transaction with TD. In May 2019, we wrote about his views on industry consolidation, “U.S. Bank M&A: 8 Drivers as Described by Industry Giant, Rodgin Cohen”.

[16] The Canadian banks are well known for energy lending with commercial and investment bankers in Houston.

[17] As of April 29, 2022.

[18] From October 14, 2020, through April 29, 2022.